Mirroring our first wildly popular post in the Advanced Lead Guide series, The Complete Guide to Door-to-Door Cold Knocking, this blog post will explore the other FREE lead generation technique that insurance agents can use to start selling policies today: Cold Calling.

We created this guide to answer the most common questions agents ask us every week. Our goal is to provide you with a resource that you eventually won’t need to use at all – meaning, we hope this guide makes you so good at cold calling that you’ll eventually grow beyond needing it.

You see, DIY cold calling isn’t meant to be a long-term strategy, but a temporary tactic to help you build your book of business, and save up enough money to outsource your lead generation so that you can focus on selling, not prospecting.

For this comprehensive guide, we scoured the entire internet and cold calling forum from the popular website, The Insurance Forums, to cover six major areas in this article:

- What is Cold Calling?

- Does Cold Calling Still Work?

- Average Daily Metrics

- How to Make Cold Calls Like a Pro

- 25 Cold Calling Script Examples

- 20 Helpful Tips for Cold Calling Success

In addition to covering these topics, we will discuss the legalities of cold calling for insurance leads, what pipeline leads are, and whether you should leave voicemails when you make cold calls.

But for now, let’s figure out what exactly cold calling is, and how it can work for agents selling insurance.

1. What is Cold Calling?

Cold calling is phoning prospects when they’re not expecting your call because they didn’t request a call in the first place. Another term for cold calling is telemarketing – which we feel is the act of outsourcing the actual cold calling to an employee or company that specializes in it.

For most salespeople, including insurance agents, cold calling conjures some sickening feelings of having to talk on the phone all hours of the day while repeating a script that induces a mind-numbing paralysis – all the while wading through a ton of answering machines and overwhelming rejections from the people who do answer – just to land a lead for every 100 people or so you talk to. Sounds daunting, doesn’t it?

To understand why cold calling fell out of favor (for both the caller and the called), let’s look at this chart from Business Balls that lists how cold calling is perceived, from the perspectives of both salespeople and prospects:

Table Title

- fearful

- boring, repetitive

- unpleasant

- pressurized

- unimaginative

- rejections

- thankless

- confrontational

- unproductive

- demoralizing

- unhappy

- numbers game

Table Title

- nuisance

- unwanted

- indiscriminate, unprepared

- pressurizing

- tricky, shifty

- dishonest

- reject, repel cold callers

- shady, evasive

- contrived

- insulting

- patronizing

- disrespectful

Benefits of Cold Calling

Why would anyone want to go through this rejection and boredom just to (hopefully) land a client? Because, as Business by Phone states:

“Telephone prospecting is the quickest, cheapest, and most interactive way to make a contact and a sale. Consider this: many of you could pick up the phone right now, call someone you don’t know and who never has heard of you, and have an electronic payment transaction minutes later.”

Not only can you develop sales quickly with cold calling, but you can also save so much money on your prospecting, because it costs about 80% less than knocking on doors.

Here are seven other benefits insurance agents can gain from cold calling:

- Reduces costs that come with hiring it out

- Saves time by quickly finding out who’s qualified, compared to other lead generation techniques…which means you can potentially write business that same day

- Promotes brand awareness of the agent’s name and their agency’s name

- Induces rapport with prospects that’s hard to create or transfer from those telemarketing on your behalf

- Creates interest in the products or solutions you’re selling

- Empowers the agent by building often-neglected sales skills in the age of email

- Facilitates a larger and fuller pipeline of warm leads that can help transition the agent from marketing to sales activity

There are a variety of reasons why cold calling may be the perfect marketing method for agents who are just starting out in the insurance business:

- You’re new and have little to no budget for buying leads

- You don’t want to outsource lead generation and would rather do it in-house

- You like the personal touch of generating leads yourself

But do the benefits of cold calling still make it an acceptable method to prospect for business? Let’s find out.

2. Does Cold Calling Still Work?

You’re probably wondering, despite the benefits listed above, if cold calling is still a viable form of prospecting. And the answer is….it depends how you use it.

If you ask naysayers like Joanne Black (author of “No More Cold Calling”), Frank Rumbaskis (author of “Never Cold Call Again”), Art Sobzack (author of “Smart Calling”), and Sam Richter (author of “Take the Cold out of Cold Calling”), you will hear a resoundingly loud opinion that cold calling is dead. (Of course, they’re quick to replace it with their own alternative sales training methods they’re promoting.)

Jacques Werth, owner of High Probability Selling, agrees that cold calling is slowly dying, but has a different view of how cold calling can still add value to an agent’s prospecting repertoire:

“I agree cold calling is [growing] obsolete. It alienates most of the people you call. However, turning cold calls into a series of warm calls is a long-term winning strategy.

It enables you to develop “favorable front of the mind awareness” in a large target market. That is important because prospects buy in their own time for their own reasons. Each time you call your list, some of them will be ready to buy and they will want to buy from you.”

Other agents feel that cold calling isn’t dead; it’s just so despised that agents would rather figure out a quicker, easier way of prospecting. In the words of an insurance agent named Ryan on the Insurance Forums:

The whole “cold calling is obsolete” thing cracks me up.

Salespeople are great at coming up with avoidance behaviors, so “strategies” and books that claim you won’t have to cold call are always attractive because they’re easy. Problem is, most don’t work, or are seed-planting processes that won’t pay off for a while. If you have five free hours a week, and I’ll bet there are few if any newbies who have less than 30 free hours a week, you should be cold calling. Exactly what would you be doing otherwise, watching ESPN?

This is why the failure rate is so high in this industry. All those “avoid cold calling” strategies.

Whether you side with the naysaying sales pros, or with doubtful agents like Ryan, here are five reasons why a lot of people think it’s getting harder to successfully generate – and close – leads through cold calling:

Reason #1: Constant Rejection

The top reason there’s such a high burnout rate for sales jobs that require cold calling for developing business is the enormously high rate of rejection. Just look at these stats that show how tough it can be to develop leads via cold calling:

- 91% of the time, cold calling doesn’t work (source: Harvard Business Review)

- Only 2% of cold calls result in an appointment (source: Leap Job)

- Less than 1% of cold calls lead to a sale (source: Direct Selling World Alliance)

Looking at those stats, it’s no surprise that cold calling is as daunting as the fear of heights or public speaking.

Reason #2: Agents Should Be Selling Not Prospecting

Many established insurance agents take the stance that cold calling is simply a waste of time. Why is that? Because usually, successful agents spend more time selling than prospecting for business. They think cold calling should only be utilized in the early stages of your business when you have more time than money for developing leads. Basically, the moral of their advice is to value your time, which becomes more valuable the more successful you become.

The better course of action would be to either find a permissive-based form of marketing that draws prospects to you, or outsource calls to a capable company that specializes in telemarketing and can leverage its employees, technology and time to make cold calling a successful venture on your behalf.

But don’t tell these agents that you don’t have the money to outsource this; you might get a response from them like, “You shouldn’t even be contemplating this career if you don’t have a marketing budget saved up when you enter it.” As nice as that would be, unfortunately not all agents come to this career with $5,000-$10,000 for marketing – so cold calling (in our opinion) is a perfectly acceptable (and affordable) activity, especially compared to doing nothing.

Reason #3: Navigating Legislative Hurdles

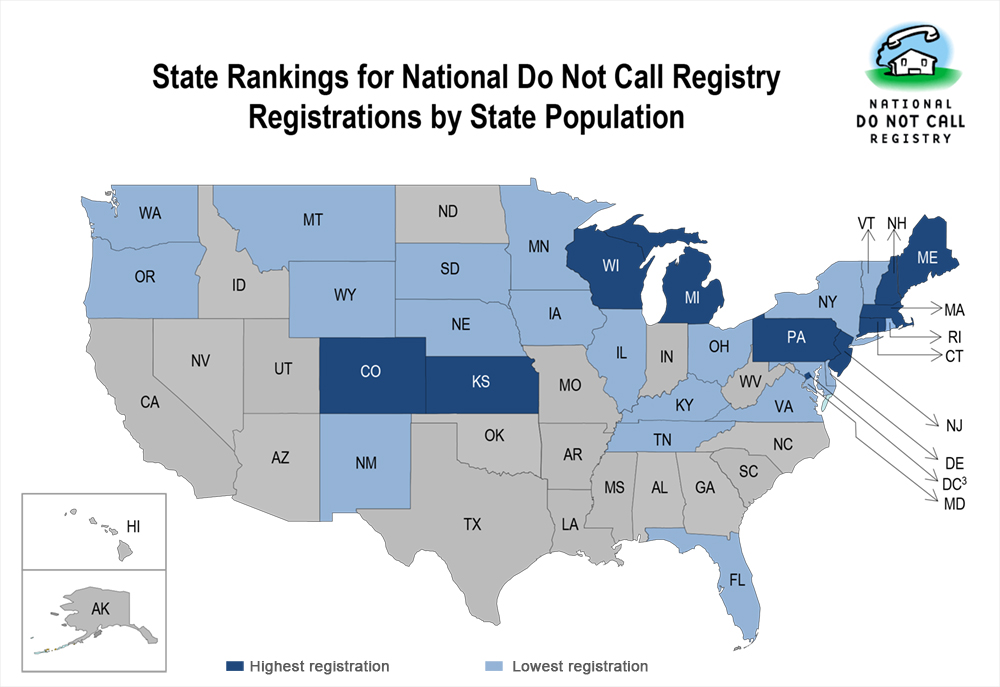

Another reason why agents often bypass cold calling is due to the onerous restrictions of the Telephone Consumer’s Protection Act of 1991, which spawned the federal Do Not Call (DNC) Implementation Act in 2003. This legislation not only requires agents to register for an identification number called a SAN number, but it outlaws the unsolicited calling of people on the list – which grew to 220 million active registrations as of September 2015.

In addition to having to register for a SAN number, agents also have to comply with the following rules:

- No calling before 9 a.m. or after 9 p.m.

- No soliciting via text messaging or ringless voicemails

- No dialing cell phones using automated or predictive dialing software, unless the consumer specifically opts into an agreement

- No using auto-dialers that deliver a pre-recorded message without the intervention of a human caller (also known as press-1 leads)

- No spoofing phone numbers, which is the act of making calls from a phone number that isn’t the business’ or agent’s official number

Because of these restrictions, many agents don’t even bother with cold calling. Todd Daviso, an Ohio-based call center owner, remarks that, despite the number of people on the DNC list, he is still able to generate leads for his agents on the phone:

“Granted that the DNC list does kill a lot of our data, we still pull a decent number of folks ages 50-80 and a household income of $25-$75K. I had to bring on 2 more and still need another 3 more telemarketers to keep up with demand and another assistant to scrub them all. My agents write an average of $100 I every week; I’ll take that all day long. So will the agent at $12-$16 per lead.”

As you can see, despite the sheer number of people on the DNC, Todd’s crew still does rather well prospecting in the smaller pond of older people not on the DNC.

Reason #4: It Still Requires Some Start-Up Capital

At the beginning of the article, we mentioned that this is a FREE lead generation idea. Technically that’s true, because any agent can open up the phone book and start dialing (assuming he scrubbed the list for the DNC). But if you really want to be successful using this method as efficiently as possible, you’ll have to invest in two core items: targeted phone data and a compliant dialer – both of which we’ll cover in more detail later. Still, cold calling is typically a lot more affordable than a lot of other prospecting methods.

Reason #5: Evolving Consumer Behavior

The reason why prospects are less likely to answer the phone, and more likely to hang up on you before you finish your whole pitch, is because of how consumers go about learning and buying their products and services these days. Their approach to shopping is very different in this era of the internet, where consumers can have all the knowledge they need to make a decision at their fingertips, and even shop multiple companies at once – which means those companies have to compete harder than ever on price to win business.

Now consumers are dictating both when and how they like to be informed on new products – and receiving unsolicited calls about them doesn’t fit into that picture anymore. This has essentially divided marketing into two camps, which we covered in our insurance sales training book: interruptive marketing and permissive-based marketing.

Because of this change in consumers’ buying habits, cold callers can expect to be greeted with a little annoyance, suspicion, brevity – or not at all (hello again, voicemail).

Other examples of interruptive marketing include:

- TV commercials

- radio ads

- cold emails

- pop-up internet ads

Now ask yourself, in addition to the occasional unsolicited phone call, do you like encountering these other forms of interruptive marketing? Chances are you detest them as much as anyone else, and you fast-forward through the commercials, get up and change the channel, or install an ad blocker for your internet browser.

Here are some more statistics that demonstrate how consumer buying psychology has changed with the advent of the internet:

- Today’s sales process takes 22% longer than it did 5 years ago (source: SiriusDecisions)

- 50% of identified sales leads are not ready to buy when you contact them (source: Gleanster)

- 89% of customers begin their buying process with a search engine (source: Fleishman-Hillard)

- Customers don’t want to deal with salespeople until they are 70% down the path of the buying process (source: HubSpot)

- 75% of customers say they use social media as part of the buying process (source: IBM)

- The number of consumer complaints about unwanted telemarketing calls increased from just under 3.6 million in 2015 to just over 5.3 million in 2016. (FCC)

- In 2004, according to Forbes, around 90 percent of us had a landline and only 5 percent of households were cell phone only. Ten years later, less than 60 percent of American homes have a landline and more than 40 percent rely on the clever thin pocket computers we still call “phones.”

- It takes 8 attempts to reach a prospect today with a cold call versus 3.68 back in 2007 (source: TeleNet and Ovation Sales Group)

- The group least likely to be wireless-only: people 65 and over. 84% still have a landline. That number is going down, however; it was 92% in 2011.

The last stat is very important for our blog readers because it’s the reason why cold calling the senior population is more effective than cold calling any other market segment in the insurance field – which is why cold calling is still an effective lead generation technique for these folks.

In the next section, we will go through other agent’s experiences and metrics to further illustrate the viability of this lead generation strategy.

Agents ARE Still Cold Calling Successfully

I can personally verify that cold calling still works, as the operator of a call center that makes almost 50,000 cold calls a day to sustainably generate telemarking leads for insurance agents. Aside from my experience, I have an even more convincing reason why cold calling STILL works as a prospecting method: the law of averages.

The law of averages states that the more people that you see (and solicit), the more sales you will make. Sooner or later, you’re bound to come across someone who needs an insurance plan. Maybe they know someone that passed away this year, or they received a direct mail piece that captured their attention, or they recently saw a commercial about getting an insurance quote. The point is: you’re looking for people who happen to be in the market at that particular time.

An agent on the forum, Dwayne, illustrates how the law of averages works with cold calling:

Let’s say that you cold call for only 4 hours per day, and you work 5 days per week, and work 50 weeks per year. And let’s also say that you are talking to only 8 people per hour, which is a low number.

8 people per hour X 4 hours = 32 prospects per day

32 prospects X 5 days = 160 prospects per week

160 prospects X 50 weeks = 8,000 prospects per year

THAT MEANS WE WOULD BE ASKING 8,000 PEOPLE TO BUY OUR PRODUCT.

If you only close 2% of the people you talk to, that is 160 sales per year. If you are new in this business like me, that should still leave you 5 more hours per day, and possibly Saturday, to do other prospecting or closing the sales that you just made due to cold calling. And a little time to fool around on the forum.

Let’s say 1% is the number, then that is 80 sales, but let’s say we continue to get better and we can close 5% of those we talk to, that could be 400 sales!

Of course, if the agent is a bumbling fool who doesn’t have a process in place to improve his law of averages, then it’s not going to matter how many people he sees – he won’t sell anything. Like any other prospecting method, cold calling only works if you work it, by following a strategic sales process. We’ll feature a few agents below who have a process in place that allows them to qualify large number of prospects per day, which in turn leads to consistent sales (assuming they hit their prospecting activity goals).

Before we share other agents’ cold calling metrics, please be aware that everyone’s numbers can differ wildly based on:

- What type of insurance they are calling about

- Whether they’re trying to qualify before setting the appointment

- If they’re being by skipping face-to-face meetings with prospects, and instead just trying to sell over the phone

- What the sales skill level of the agent is, and whether they’re new or established within the industry

- Whether they’re using any automated software like a dialer or CRM to help them quickly contact and track prospects

- The quality of sales data they’re using to make their calls

Many factors might determine what makes some agents succeed and some fail. With that in mind, let’s see what cold calling metrics might look like for insurance agents.

3. Insurance Agent Cold Calling Metrics

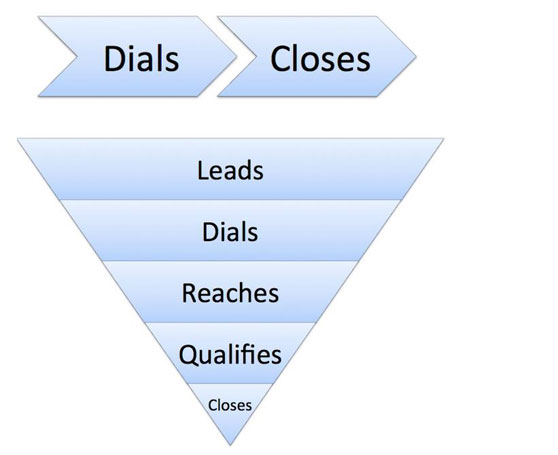

So, let’s get down to some nitty gritty numbers so you can see:

- Number of hours agents spend dialing each day

- Number of contacts they make

- Different sales dispositions they encounter (voicemail, not interested, etc.)

- Whether they leave a message or use a dialer

- Number of leads developed

Not all agents track their metrics one specific way, and not everyone has the same sales skills – so everyone’s results will be different.

Decision Man:

Using 3 lines and a halfway decent list, I average 177 dials per 100 minutes (that includes time spent in conversations leading to a no, a callback, or an appointment set). My results vary depending on if I’m cold calling Final Expense, Med Supps, LTC, or annuities. (Calling businesses is a completely different discussion).

For the money (for me), Mojo and cold calling is better than money on mailers. But everyone on these forums has much different experiences with different forms of prospecting.

I have a list coming of 4,300 numbers of high-income 60-70-year-olds that I estimate will last a little over 14 days if I spend 3-4 hours dialing per day to complete the first pass (including leaving voicemail messages). Given appointments, travel, case development, underwriting follow-up, etc., I figure I’m good for a few months on this list (but I work several lists for different markets).

360:

With Medicare Supplements, you can expect to get 3 positive responses, the equivalent of 3 leads, per 100 dials. Out of 20 leads, an expectation of 1-4 sales isn’t unreasonable. You’ll dial 50-70 numbers per hour once you factor in that some of those calls turn into conversations. You’re the appointment setter and the agent, so your conversations will be longer than a call center agent that usually transfers the lead. So, it’ll take you about an hour and a half to get 3 leads. So, 10 and a half hours on the phone to start seeing the conversions.

GoPokes:

I only cold call for T65 sales. When I worked for a captive agency, I did cold call lists age 65-80, and I trained others on how to do it.

It can work very effectively, in fact it’s usually a very cheap lead when compared to DM leads. Obviously, most people hate doing it, and that’s why they buy DM leads.

As far as how many dials per month I make, I probably only do about 500-1,000 (just a guess). That may be a bit high though.

Chazm:

If you’re going to cold call, it needs to be 5-8 months out of turning 65.

That said, you should get 1 answer for 10 calls and 1-2 appointments per 10 answers. You can probably sell more than half that you see if you’re qualifying on the phone. So, work that backwards if you want to know how many calls to make.

DM return rate will probably fall anywhere between 1.5% to 5%. Averaging 2.5%.

I probably close about 10-15% for T65, not factoring referrals.

Patrick Pegram:

Our demographic for FE is: age 50-78, income 0-75k, names by county, with phone numbers and scrubbed against DNC).

Here is the breakdown for 5 hours of dialing per day on a predictive dialer (9a-12p and 1:30p-3:30p local time). I recommend 2 days of calling, M & W / T & Th. 10 hours of dialing. Splitting the days is recommended due to weather, mood, bad day, etc. to get a good average on calls.

- 1,600 Dials made in 10 hours (per telemarketer)

- 5% Disconnect, Fax, Wrong Number

- 2% Dialer Error, Call Dropped

- 77% No Answer, Busy, Answering Machine, Voicemail

- 16% Calls Connected

- 47% Not Interested, DNC Requested

- 29% Call Back at another time

- 10% Hang Up/No Response

- 8% Language Barrier

- 6% Leads

The leads generated are those that have answered basic knock out questions for FE and have a checking or savings account. They also know an agent will call them to talk within 24-48 hours. Out of 10 hours of dialing, you should get 13-16 good leads to set appointments and sell FE.

Here’s something similar to what we say when we call:

“As you know, the recent downturn in the economy has made family budgets stretch to the maximum, and I am doing my part to make those dollars you spend on insurance less costly for you. I can meet with you on ______ to show you how your savings can be maximized in these tough times…”

And just to show that I like to participate, here are some stats from Lead Heroes’ own call center:

- Average telemarketer for my call center makes between 1,000 – 1,200 calls per day

- About 40% of calls listen to the pitch before saying ‘No’

- About 50% of the Med Supp leads on the list contain info about monthly premiums (exact or approximate)

- About 75% of leads on the list contain the company name of their Med Supp policy

- It takes about 100 to 150 contacts to develop a lead (depending on the area)

- Average call length of a Med Supp lead: 2 to 3 minutes

- Average call length of a standard FE lead: 1 to 2 minutes

- About 33% of standard Final Expense and Medicare Supplement leads contain spouse info.

- Average number of calls it takes to generate a term lead: 300 to 500.

We could devote another entire blog post to sharing more stats like these, but the two main things to be aware of is that everyone’s stats will be different depending on so many variables, and the kind of stats agents like to track can also differ.

While it can be helpful to have some actual numbers to compare your performance against, the real value is learning from other agents to see how they approach their cold calls, and applying their best practices to make your next dialing session more successful. So let’s see how other agents cold call.

4. How Do You Make Cold Calls?

Before we get into script examples, this section will cover the basics about making cold calls – including the different types of markets you can cold call, the two main fears of prospects you get on the phone, the major parts of a cold call script, and the four types of outcomes that could happen – and how to handle each.

Markets and Types of Insurance to Sell

Now that we’ve explained the hardships of cold calling, let’s explore the two general markets that agents can cold call to generate leads:

- Residential/B2C

- Commercial/B2B

This guide will only cover the residential/B2C side of cold calling, since most agents reading our blog sell to consumers, not businesses. (The only exception is when we discuss the various components of a cold call script below, illustrated by a B2B cold calling script.)

Residential B2C Markets

The residential market can be divided into two main groups:

Pre-Retirees: Including Baby Boomers still working, along with Generation Y and X’ers

Retirees: Including Baby Boomers that have retired and the “Silent Generation” of seniors who are in their 70s and older.

You’ll notice we didn’t mention Millennials; that’s because they’re notoriously less likely to own a landline or to be receptive to interruptive marketing techniques.

Within these demographics, here are the different types of insurance that health and life agents can effectively cold call for, ranked from most common to more difficult:

Retirees

Medicare Supplements – perhaps the most popular type of insurance to cold call for

Final Expense Life Insurance – the second most popular type of insurance to cold call for

Mortgage Protection – As older Americans are buying homes and refinancing, the cost of permanent insurance to cover this obligation is more expensive than they can afford – hence this population’s increased interest in term life insurance.

Retirement Planning – This is a tough market to prospect for, but with the help of Bill Good’s Marketing System for Financial Advisors, agents are armed with proven scripts that enable them to effectively prospect.

Medicare Advantage Plans– Just kidding! CMS strictly prohibits any cold prospecting methods to get in front of seniors to sell MA plans. Don’t forget that or it’s your license on the line!

Pre-Retirees

Mortgage Protection – This is technically term life insurance, but can cover the mortgage payment if anything should happen to the breadwinner(s).

Health Insurance – Obamacare’s uncertain future, combined with escalating health care costs and an absence of health insurance navigators to help consumers compare their options – mean there’s an opportunity for agents who can capture a prospect’s attention.

Term Life Insurance – for survivor income replacement and final expenses

Essentially, within insurance, it’s easier to market to the older audience for three major reasons:

- They’re more likely to be at home.

- They’re more likely to own a landline phone – and answer it.

- They’re more accustomed to conducting business on the phone – unlike younger generations.

Because of those three reasons, this guide mostly focuses on prospecting to that older market.

Two Fears Prospects Face

Before we explore the different parts of a cold call, we need to understand why a successful script is designed the way it is. Essentially, the purpose of a script is to discover or create interest, while also overcoming two fears that prospects usually have when confronted by a telemarketer:

- Losing Time

- Losing Control of the Conversation

Just think back to the last unsolicited call you had. Chances are, one of these thoughts entered your head.

- “Ugh, I don’t have time for this!”

- “How long is this going to take?”

- “What kind of scam is this?”

- “What am I going to be railroaded into this time?”

- “How dare this telemarketer-scum-of-the-Earth interrupt me with an unsolicited call!”

As a cold caller, these common thoughts are your enemy, so to speak, and your script is the sword you use to defend your pitch. If you’re just counting the number of ‘No’s’ you’re getting, it might feel like you’re fighting a losing battle – but if you understand how cold calls work, you know that, despite the overwhelming number of rebuffs you experience, you can still win the war if you can just convert a small percentage of prospects into leads.

Converting cold calls requires a well thought out script that not tackles the inherent fears mentioned above, and ushers the prospect through a qualification process to convert prospects into leads, which hopefully, can then be turned into a client or two.

Anatomy of a Cold Call

One of the most gifted cold callers who shared his advice on The Insurance Forums was Matt Englemann, known by his username, Full Throttle. Although he primarily worked the B2B markets, every type of agent can learn a lot from Matt’s approach; after all, he did undergo extensive training in the top cold calling courses around the world (including Ari Galper’s).

The rest of this section is quoted directly from one of Matt’s posts, where he breaks down the 5 main parts of a cold calling script:

1. The First 10 Seconds

2. After the First 10 Seconds

3. Probe for Pain or Interest

4. Close for Next Step

5. Sell the Appointment

Of course, his process isn’t set in stone and won’t work for everyone. He uses examples from a B2B health insurance script, for example, which you may need to tweak for your purposes. He also qualifies the prospect’s pain a bit before setting an appointment – which some Final Expense and Medicare Supplement agents prefer to save for the face-to-face meeting. But pay close attention to the structure of his script, because it’s a great springboard to help you understand the various parts of a cold calling script and the purpose of each stage.

First 10 Seconds

Purpose:

Get permission to move forward and alleviate prospects two main fears (listed above). You also want to sound different than the other telemarketers making calls to the prospect.

Two Components:

- Interrupt the usual pattern of calls they usually

- Get permission and ask for to move forward

Key to this Step: Get to the next stage of the call

Example:

“Hi Mr. Prospect, this is Ted Smith giving you a call. I’m actually calling you as a cold

call and I’m sure this isn’t the first one you have ever received. (interrupting

usual pattern) Would it be okay if I take 30 seconds to tell you why I called, then you can tell me whether or not we should talk further?” (ask for permission & alleviate fears)

Other examples of interrupting the usual pattern:

– “I’m calling you as a cold call and I’m not very good at making these kinds of calls.”

– “This is a sales call. I’m sure you don’t like getting these, and I sure don’t like making them.”

– “You won’t recognize my name. We haven’t talked before.”

Once you get past the introduction, the most difficult step of the call is completed. A good first 10 seconds will get you to the next stage of the call the vast majority of the time.

After the First 10 Seconds

Purpose: Find out if the prospect has enough discomfort to warrant talking further. If yes, you move forward. In no, the call ends.

Keys: Have relevant statements that discuss the pain your prospects will be feeling.

Examples: would include price, benefits, rate increases, or benefit communication in the group scenario. However, I find price is usually the main driver. Also, during this stage, talk conversationally and take a “who cares” attitude.

Remember: good prospects are found, not made. Don’t appear overeager.

Example: “I work with health insurance and I’ve talked to a number of business owners lately who are frustrated with their premiums (pain #1) or feel that for what they are paying, they aren’t getting much in return (pain #2). Are either of those concerns of yours?”

If you get a yes, you keep going on with the call. If not, end the call.

Ask Probing Questions

Purpose: Have a conversation to explore whether or not you can help or if they even want your help. If you think you can help and prospect may want help, then go onto the next step.

Keys: Let the prospect do most of the talking. Use your product knowledge and experience to ask relevant questions. Again, don’t appear overeager!

Example of Probing Questions:

“What carrier are you with now? How long?”

“Besides the premium, are you happy with the plan?”

“What type of options have you already looked at to get the premium down?” (will likely expose health issues or current agent in the mix)

If you think you can help and the prospect qualifies, move to the next step.

Close for the Next Step

Purpose: Test prospect’s desire to take action and secure commitment to take the next step (face to face meeting, for you to look into their situation, set up a presentation depending on your sales process)

Keys: Give the prospect an easy out and don’t appear overeager (notice a theme!)

Example: “If it’s enough of a concern, I can take a look and tell you whether or not I can help. If I can, I’ll tell you that and if I can’t, I’ll tell you that, too. If it’s not much of a concern, that’s fine, we can end the call. What do you think?”

If you got this far, the rest is easy. Get the relevant information to start looking at options (ages, nicotine use, current plan details including premium, deductible, copays). Then simply describe what the rest of the process will look like, letting them know there is an out at any time.

Sell the Appointment

Purpose: Decrease canceled or rescheduled appointments/meetings. If a prospect gives you this extra commitment, it’s more difficult to change things around later.

Example: “Mr. Prospect, sometimes when I schedule meetings with people I find they schedule them on a whim. It’s probably not the case here, but I wanted to make sure to ask, is there any reason we would have to reschedule on your end? If so, can we do it now?”

Four Main Outcomes to a Cold Call

Before you start calling, you’ll want to be prepared for each and any of the main outcomes to a cold call – that way, you can both navigate the call and track these as metrics to measure your success.

The four different outcomes to a cold call are listed below, in order of how often you’ll come across them:

- Voicemail: If prospects aren’t home – or are, but aren’t answering their phone – you’ll often land in the answering machine.

- Objections: You’ll only covert less than 5% of the people you talk to, so be ready to hear ‘no thank you,’ ‘we’re all set here,’ ‘not interested,’ and other objections – and to respond accordingly.

- Pipeline Lead: Many people you talk to who don’t reject you outright may just delay you, asking you to ‘call me back later.’

- Pitch: If the planets align in your favor, you may get this best possible outcome – where the prospect allows you to present your sales pitch over the phone, or set up an appointment to learn more (depending how you prefer to sell).

We’ll go into the first three outcomes in more detail below, and cover the fourth one in the next section.

Voicemail – Should You Leave One?

A very divisive topic that’s often debated in the insurance industry is whether you should leave voicemails when you make cold calls. The majority of agents who cold call don’t leave voicemails on prospects’ answering machines because it takes more time to leave messages. Most agents feel their time is better spent finding someone who answers, than leaving voicemails that might get a 1 percent call back response rate.

However, a small minority of agents leave messages for a variety of reasons:

- They’re cold calling a small area that has less call data

- They believe in brand saturation and understand it takes 8-12 brand mentions to develop trust

Here are some pretty compelling points from a few agents on the forum who see the advantages of leaving voicemails when they cold call:

Midwest Broker:

When I see a number on my caller ID and no message, then I feel that the call was not important, and I should not worry about it.

I do not think that is the message that you want to give to your potential clients. I always leave messages, but then again, the senior market is much better about calling back.

Sam:

I never leave a message on the first or second try, because I want to call back without them feeling harassed. However, I will usually leave them a message on the third try, and I have had a few callbacks. I would guess that 1 out of 300-400 will call me back. Since the message that I leave is very explicit and clear about what I do, the ones who call are excellent leads.

From a strictly economical view … my message is not the best use of my time. However, there are tangential benefits that also count for something. Firstly, it feels great to have someone call out of the blue and buy insurance. Anyone who gets good referrals knows that. Also, it puts your name out there. When you get your name out there enough, eventually it will bring some benefits. Also, I feel like I get closure when I leave a message. I try 3 times, if I don’t get through, I leave my message and get closure. I know not to call again for a few months and it is easier to keep track of.

So what makes a good voicemail message that increase the likelihood of reconnecting? I think the people over at Sales Scripter had it right when they gave these 7 tips to leaving a voicemail, summarized below:

- Don’t expect a call back

- Don’t ask for a call back (echoed by another cold calling author)

- Don’t sound like a salesperson

- Don’t talk about your products

- Educate the prospect on the problem you solve

- Use brevity

- Be prepared with a script

Let’s go over some of the ways other agents leave voicemails, taken from The Insurance Forums. This first one is used by an agent on the forum when calling aged life leads, which is practically like making a cold call – because it’s been some time since they submitted a request for an insurance quote.

“Hi (first name of prospect), Agent here, just calling to follow through on your request for term life insurance. Many of our clients elect to get all of their premiums back after the term of the policy. (first name), not only can we provide solutions for your life insurance needs, we can also provide you the opportunity to recover all of your premium dollars at the end of the policy term. This may provide you additional retirement dollars if needed. If you’re interested in even more details, I can be reached at (XXX) XXX-XXXX. That’s (XXX)XXX-XXXX. The coverage is excellent at an incredibly reasonable rate. Thank you very much and have a terrific day!”

I can get to the phone number in about 30 seconds, and read the whole thing in 42 seconds. I get a 1.5% call back rate on these messages. At the same time, I have noticed that if I leave the message and then call the person back later, and mention the message I left, it does warm up the call a bit. So, the direct impact is minimal, but like any marketing, it can have a positive influence that combined with other touches can lead to an appointment and eventually, a sale!

Here’s another way an agent from the forum leaves messages:

I always leave my number three times in the message. Once up front:

“Hi this is g-squared calling you from my office in our city at three one two (brief pause) five five five (brief pause) five five zero zero. The reason for my call is….”

And repeat it (phone number) twice in the call to action:

“If you have an interest in learning more, I can be reached at (a bit more slowly this time) three one two (brief pause) five five five (brief pause) five five zero zero. That’s three one two (brief pause) five five five (brief pause) fifty-five hundred.”

How often has a prospect on a cold call returned my call? Maybe once in 1000 messages, if that. But I have had several prospects say they remembered my message when I contacted them again, perhaps in combination with a mailing I’ve sent.

Bob the Insurance Guy:

Very rarely do I leave a message, but when I do, I say this:

“Mike, jot down this number. 770-374-4531. Call and ask for Bob Levine. Might be of some help to you.”

I say it in a very matter-of-fact tone. It’s quick (7 seconds), gets them involved (writing the number and name), and piques their interest. No company name, no industry, so there are no preconceived notions, no assumptions to block you. In other words, they won’t say, “Oh, I don’t need another insurance guy, real estate agent, etc.”

Time is valuable. Don’t waste theirs with a product dump or intro to your company. Just direct them to call, and ask for you. That’s all you need. You can take it from there.

Kris Willy:

What you want to do is leave a message that creates interest. A teaser, as they would call it in radio. Why should I call you back? What’s in it for me? Quick and concise! I usually average about 1 call back out of 20 messages if not more. It’s not what you say, it’s how you say it.

“Hey ______, this is Kris Willy with Colorado Health Solutions here in Denver, I just wanted to let you know that there are some new health insurance plans available that most people don’t even know about that are designed to save you money. I just need to know where can I send your quotes to? Call me back at xxx-xxx-xxxx and let me know.”

Also, I always make sure to tell them where I am located, “Hey I’m local and a real live human being, I’m not someone calling from Florida!” People can relate and picture in their minds where you are calling from then. (If they are close, I will even throw out the cross streets that I’m at).

John Petrowski:

That’s basically my question; is it worth it? If one of 300 return the call and it takes me 15 seconds to leave a message, that’s 75 minutes of leaving messages for one lead. If I just kept calling for 75 minutes, I would get 3 more leads just by reaching people. In order to make up for leaving message, that means I’d have to spend an extra 75 minutes per day on the phone.

I’m leaving very short messages but it’s a short intro to why I’m calling:

“I’m John Petrowski, the owner of Health Solutions and I’m calling because a lot of the top companies like Aetna, United Healthcare and Time Insurance now have new health insurance plans with lower rates. I’d like to send you the rates and plan details, so you can compare what’s available. Call me back at 410-874-7241.”

It’s literally 12 seconds.

Extra:

I use email attached to the voicemail now so not only are they getting a voicemail, but they are expecting an email from me as well.

I will circle back. I have kind of given them three things to expect.

They are going to get another call from me, and they are going to get an email from me, and I’ve left them this message. It is almost like they have to call me, and they do.

Again, it goes back to association. They heard you leave a message, they delete the message, and then you call, because you told them you were going to call, and now there’s something about you they like; there’s something familiar.

I have that technique. I say, “It really works better when you’re ready, so when you’re ready just give me a call and I’m here.” And sometimes it takes a couple of weeks, sometimes it takes a couple of months.

Perhaps the simplest of tips for leaving a voicemail comes from Think Advisor contributor, Bill Good:

When you leave a VM, immediately state your phone number. Your client or prospect will scramble for pen and paper. You have their attention.

Now that we’ve seen how other agents leave messages, let’s see how they work with objections.

Objections – Should You Overcome Them?

Another divisive topic that agents debate when cold calling is whether you should attempt to overcome objections. Again, most agents feel their time is better spent getting someone else on the phone who may be open to hearing the pitch, rather than spending time and energy overcoming objections.

Some agents, however, would rather try to overcome objections. Here’s why:

- Most people need to be asked more than once if they want to buy

- The agent may be working a smaller local area, and needs every lead he can get

- The agent wants to reposition another product and maximize the number of pitches, since they went to the trouble of getting ahold of a live person

Let’s take a look at how some popular cold calling trainers handle objections. The first example is from the world’s premier cold calling trainer, Ari Galper:

After you respond with “That’s not a problem” or another graceful, relaxed, low-key reply, your next step is to pause for a moment to let the other person take in what you’ve just said. They may be surprised because they didn’t expect that response. Let them have that time. Then, when it feels natural and comfortable, open up the conversation again with an appropriate phrase that goes behind or beyond the objection.

You can then ask a question that gives the other person the message, “I’m not going to try to persuade you otherwise, but I would like to know if you’re open to looking at this from a new perspective.” With this in mind, what you say next will really depend on the specific objection. You’ll notice that the suggested phrases “Would you be open to…” and “Would it make sense…” occur a lot in these examples. These wordings are important because you’re showing respect and simply asking prospects whether they’re open to considering something new, so it makes sense to continue your conversation.

The more you can shift from “Fight or Flight” mode to “re-engage” mode, the more you create trust and allow the conversation to re-open again without pressure.

Here’s another example from Chris Gallespie on the Marketo blog:

“I understand that you’re not interested right now. I can respect that. I have to ask though, is my timing just off, or are you flat-out not interested? Either way is totally fine. I don’t want to bother you if I’m way off the mark.”

Some agents will try to contour their cold call introduction to curtail objections by utilizing specific phrases in certain ways, like this one from the forum:

“Hello, Bob? It’s ______.”

You’re acting like they know who you are, so they will listen to you longer. It sounds less salesy. If you ask to speak with Bob and Bob is on the phone already, they instantly know you’re trying to sell them something.

Since people are pre-programmed to say no, if you will phrase your question so that a “no” gets you the desired response, it is easier.

Example: “Is this a bad time to talk?”

For agents wanting to get more specific objection responses be sure to check out our blog post on handling objections.

Pipeline Leads – The Holy Grail of Prospecting

According to sales coach Sid Walker, prospecting is looking for people who align with you in two ways: chemistry and timing.

Having chemistry means you found a prospect that is open to hearing what you have to say, maybe because:

- Your phone number is local

- You didn’t come off too salesy

- When looking up your info online, they found an esteemed and developed brand

- They like the way you talk

In short, you could say that if you have chemistry with a prospect, they trust you to a certain degree – which is vital if they’re to take your call or schedule an appointment with you.

If the prospect happens to need whatever you’re selling, then you could say the prospect also matches your timing.

To create a lead, the prospect needs to have both chemistry and timing. A prospect that has a need but doesn’t trust you, will probably not end up a high-quality lead – in fact, you might have to chase them until they either warm up to you or they tell you to buzz off.

A prospect that trusts you but has no need, still isn’t a high-quality lead because no matter how much they like you, they still don’t need what you’re selling. This is where you ‘stash’ that prospect away into your pipeline list to stay in contact, and hope that as time goes by, they may develop a need – whether it’s because of a recent death in the family, or a sudden large rate increase on their current policy.

So, as you’re filtering prospects, know that a certain percentage of people that ask you to call them back (because they might have chemistry and timing) or that you ask to stay in contact with (because the timing isn’t quite right) – will end up becoming clients later on down the road. Which is why, to make the most of your time, it’s indispensable to start creating a pipeline list of people you can follow up with every 3, 6 or 12 months to see if they’re interested.

This practice is exemplified by two agents from The Insurance Forums:

Scagnt83:

NYL used to train agents to do this when you are denied an appointment. They said to respond with “I understand… instead, would you allow me to add you to my monthly newsletter recipients?”

Many would say yes to this. I think the fact that they just told you “no” actually helps. They at least a little bit feel bad about saying no. So, they feel better saying yes to the second request since it is non-confrontational & takes no time on their part.

If they say yes to the e-newsletter, then put them on a follow-up list for 6 months out. I would contact them twice a year. Not pushy, just a quick check in to see if anything has changed with their insurance needs. Possibly even ask if they found any of the articles interesting or relevant to them. You will be much more likely to get appointments from the follow-ups vs. them calling you. The newsletter builds credibility and gets you in their mind. It also might get them thinking about insurance needs that are not currently or fully covered. So, when you call them to check in, they are more likely to discuss those needs with you.

“Thank you. That’s not a problem at all — my only goal was to identify whether I could help you or not. It sounds as if in this situation that I can’t. Thank you for your time, and have a great day.”

or

“Not a problem — I just wanted to make sure that there wasn’t something here that I could help you with.”

Frank Stasny:

When I have them on the phone, the main piece of info I want from them is the name of their current insurance company. If that’s all I get from that phone call, it has been a successful call.

Whether you find out their current company so you can call them back when they get a rate increase, like Frank did, or you get their information and drip on them over time, like Tyler did – you can stock your pipeline, so you can eventually start dealing with warmer leads.

5. Insurance Cold Calling Script Examples

Buckle up and get ready. We scoured the entire ‘cold calling’ section in the Insurance Forums, and then combed the rest of the internet to locate the very best insurance cold calling scripts for you.

To make these less overwhelming and easier to navigate, you will see links to every script listed and for what type of insurance it’s for. Just click on any link to be instantly transported to the script, or feel free to peruse them all below.

- Investments #1

- Investments #2

- Annuities or Retirement Planning

- Final Expense

- Turning 65 (T65) Medicare

- Medicare Supplement #1

- Medicare Supplement #2

- Mortgage Protection #1

- Mortgage Protection #2

- Financial Planning #1

- Financial Planning #2

- Medicare Supplement #3

- Final Expense #2

- General Life Insurance

- Turning 65 (T65) Medicare #2

- Turning 65 (T65) Medicare #3

- Turning 65 (T65) Medicare #4

Investment Cold Calling Script

The first two examples are from Bill Good, a premier marketing trainer for financial advisors who has amazing resources and more scripts on his site. His scripts target prospects for retirement planning, which due to its complexity is a harder market to prospect for with cold calling. In this first example, Bill lets agents know what he likes and dislikes about the script – which he obtained by asking tons of agents to submit which script worked best for them.

Why I like it: Qualifies quickly. Doesn’t argue or try to overcome objections. It’s a great “fish or cut bait” script. Demonstrates the importance of “Yes/No” questions in prospecting.

What I don’t like: No options to develop prospects that do not immediately set appointments.

Suggestions: Make sure you fully understand how to move from one option to another.

“Hello Mr./Mrs. X, this is My NAME and I am with My FIRM. Have your personal finances been affected by the recent market downturn?

IF NO: Are you comfortable with your current investment roadmap?

YES: Thank you for your time.

NO: Would you be open to discussing what would help you be more comfortable with your financial roadmap?

NO: Thank you for your time.

YES: I’m sure you are busy and to ensure that our meeting is beneficial for you, could you answer a couple of questions?

YES: Qualifying questions—IF (THEY) FIT PROFILE, THEN SET MEETING. Would you be able to meet with me [when], [where]?

YES: Are you comfortable with your current investment roadmap?

YES: Thank you for your time.

NO: Would you be interested in meeting to learn how to get your financial roadmap back on course?

NO: Thank you for your time.

YES: I’m sure you are busy, and to ensure that our meeting is beneficial for you, could you answer a couple of questions?

YES: Qualifying questions—IF (THEY) FIT PROFILE THEN SET MEETING. Would you be able to meet with me [when], [where]?

Tax-Free Bond Fund Dialogue

Note: This script has been used to open tens of thousands of new client relationships.

“May I speak with M/M ___________, please?

M/M __________, this is (NAME)’s office from (COMPANY) here in (PLACE). I have some important information on what’s called a tax-free municipal bond fund. Have you ever heard of one of these before?”

Whether they say yes or no:

“Basically, (as you know,) it’s a portfolio of tax-free municipal bonds that have been selected for both income and safety. Could I send you some information on it?”

If they’re not interested:

Thank you very much and have a great day!

If they’re interested:

“Very good. M/M _________, if you like the idea, would an investment of $___________, be a problem for you at this particular time?

If money is tight:

“That’s fine. Tell me, when in the next 6 months, do you expect to have some money available to invest or re-invest?”

“All right. Tell you what I’ll do. I’ll send you a letter introducing our (COMPANY) team and some of the services we provide. I’ll stay in touch from time-to-time and call you back around (DATE), when your funds should be available. Fair enough?”

If money isn’t a problem:

Great. I’ll send it out to you right away. I have your address down as _________________________. Is that correct?

Just one other question and I’ll let you go. In case I can’t get in touch with you during the (evening/day), how can I reach you during the (day/evening)?

Close:

Thank you very much and have a great (day/evening)!”[/vc_column_text][/vc_column][/vc_row][vc_row el_class=”left-alignW”][vc_column][vc_column_text]

Annuity or Retirement Planning Cold Calling Script

“Hello, may I please speak with ?

, this is Agent with XXXXX calling you from my office in Joliet. I am calling to describe an opportunity I currently have for investors who are not happy with their current CD rates. , do you have any CDs?

Are your CDs earning double-digit interest?

If you have a $100,000 CD…and you’re lucky to be getting 2% return, then you’re making $2,000 on that…RIGHT?

If you’re in a 25% tax bracket you probably are netting around 1.5%…

If you could get a 4% return instead of a 2% return…in the same tax bracket you end up with 3%, right?

Which is double or 100% more…right?

What would an additional $1500 mean to you this year? What could you do with that money?

What I would like to do is to have the opportunity to meet with you to review your current situation, to give you all the facts and figures. We can discuss it together, and then you can decide if any changes are necessary. Would you be open to meeting with me on this?

What time generally works best for you, mornings or afternoons?

That’s okay. Would you be open to receiving an e-mail newsletter from me that describes strategies you can use to be debt free and truly wealthy? I’ll just need your e-mail address….

That’s okay. While I do enjoy talking with investors about their CD rates, what I actually enjoy most is presenting mortgage protection and supplemental retirement programs, because I find that 97% of all families fall short in at least one of these areas.

Would you consider your mortgage protection or your supplemental retirement program more important?

If I might ask, what is the approximate remaining balance on your home mortgage?

And how many years do you have remaining on your payments?

As you may be aware, over the life of you mortgage you’ll pay more than $________ in interest payments. If I could show you a way that you could save over $___________ (15% of mortgage amount) in future interest payments and allow you to have the mortgage paid before you retired, would you be open to meeting with me on the subject?

What time generally works best for you, mornings or afternoons?

That’s okay. Would you be open to receiving an e-mail newsletter from me that describes strategies you can use to be debt free and truly wealthy? I’ll just need your e-mail address….

Great, I’m glad to hear it. You’re smart. If you don’t mind me asking: What kinds of retirement plans do you have?

IRA___________401(k)___________Company-provided defined benefit pension plan___________Anything else?

What type of investments do you use in your retirement plan?

Fixed interest___________Mutual funds___________other?

Are you currently contributing to your retirement plan on a monthly basis? if no, how do you feel about that?

Has anyone taken the time to calculate how much income you will need at retirement?

Has anyone calculated how much money you will need to generate that income?

How do you feel about that?

What I would like to do is to have the opportunity to meet with you to review your current situation, to give you all the facts and figures. We can discuss it together, and then you can decide if any changes are necessary. Would you be open to meeting with me on this?

What time generally works best for you, mornings or afternoons?

That’s okay. Would you be open to receiving an e-mail newsletter from me that describes strategies you can use to be debt free and truly wealthy? I’ll just need your e-mail address….”[/vc_column_text][/vc_column][/vc_row][vc_row el_class=”left-alignW”][vc_column][vc_column_text]

Final Expense Cold Calling Script

Thad, who runs his own call center of insurance agents and telemarketers, shares his script for calling for Final Expense:

“Hey Bob, this is Samantha, did I get you at a bad time?”

(yes or no) “I am sure my name is not familiar to you; would it be ok if I take 15 seconds to tell you why I’m calling and then you can decide whether we continue the conversation?”

(yes) “The reason for the call today is I help out folks in (place, county) with state approved life insurance and what I would like to do “if it’s ok?” is spend a quick 30 seconds with you so that you and I together can find out what life insurance programs you may be eligible for. Would that be ok?”

Verify first name and last name.

“Did you want enough coverage to just cover your burial, or did you want more?”

“Last few years anything major, heart attack, cancer, stroke, etc.?”

Verify address.

“Well Bob, I just noticed I am going to be in your area…. What I would like to do is swing by for 10 minutes and go over all the pricing and details with you, would that be ok?”

Verify cross street, apt numbers, gate codes, etc.

Get all the objections and rebuttals in writing and use them every single time word for word. Be short, sweet and to the point.

The reason I ask permission is because I want to talk with people that want to talk to me. You go thru more calls, but you get more quality, versus bullying them into a conversation or appointment.

Turning 65 (T65) Medicare Supplement Cold Calling Script (for Appointment Setter)

“Is ____________ home?”

“Hi ____________, ____________ here, how are you today?”

“Great, the reason I’m calling is that I am reaching out to all people turning 65 in the next year because of the transition onto Social Security and Medicare for most Americans. (Agent’s Name), for whom I am calling, has been educating people nearing 65 for nearly 20 years, and would like to find 15 minutes to introduce himself and give you a card at some point in the next week.”

“I realize that between direct mail and other phone calls, you are more than likely getting bombarded with companies and insurance agents wanting to talk with you. We are different. Because we have been doing this a long time, we just want to introduce ourselves, talk a little bit about Social security, Medicare, and Medicare Supplements, and that is all. It’s a process, and we know this is a big point in everyone’s life, so we approach it different. If you have 15-20 minutes, it would be worth your time to meet ____________.”

Medicare Supplement Cold Calling Script #1

“Hi (client first name), this is (your name). I am an independent Medicare Supplement consultant in (town). I work with all major Medicare Supplement plans and can provide you with comparisons of benefits and prices from each company. There is not a fee for the service and I can drop the comparison off, introduce myself and answer any questions you may have. I’ll be in (town) on (pick a day). Would morning or afternoon work better?”

Medicare Supplement Cold Calling Script #2

Joshua Stacy, owner of ListShack (one of the top data vendors we surveyed in our article about sales data lists), had this to say about cold calling for Medicare Supplements:

A few thoughts in no particular order:

- Asking for people by name typically brings up more defensiveness/hostility than it does help building trust. Unless there is a very specific person you’re calling for, pitching whoever answers the phone is usually your best bet.

- People want to know really quick why you’re calling them; your name and the company you work for rarely helps that.

- If it’s a bad time, they’re just blowing you off most of the time and it’s not worth the time to continue to call people that are just blowing you off.

The type of pitch I’ve seen that works well is:

“Hi, how are you doing today? I’m glad/sorry to hear that. I’m calling you today because I’m helping people save hundreds of dollars on their Medicare insurance; would you like to find out how much I can help you save?”

After trial and error, I’ve found my telemarketers always did better for me by just pitching whoever answers the phone. This lets you avoid mispronouncing their name, asking for the wife when the husband is answering, and a list of other problems that come from disjointing the conversation right off the bat. On this point, it can be a matter of preference; some folks that consistently buy lists from me insist on getting first names because they call specifically looking for that person. That tends to have more to do with the T65 and business lists than FE or most others.

Mortgage Protection Cold Calling Script #1

This is also from Joshua Stacy, concerning cold calling for Mortgage Protection (Term Life Insurance):

“Hi, how are you today? I’m calling you because I’m helping folks cover 100% of the cost of their mortgage if something happens to them, and we actually have a program that will let you get back 100% of what you paid if you don’t use it. Has anyone talked to you about that before?” Another last sentence would be “Would that be something you think might help you?”

You need to hit on a hot button and have a serious conversation starter. Just asking about the level of satisfaction is remarkably unremarkable. What answer could they give that doesn’t shut up the conversation. “It’s great, thanks for asking.” “I don’t have any and I don’t want any.” Where are you going with that? By contrast, if you’re asking questions like, “Have you heard about that?” you’ll hear a yes or a no, from a yes you can say “great, did you go ahead and sign up for that?” If they say no, then it lines you up to explain it. The point is that regardless of what they say (outside of eat dirt and die) you have a comfortable flow to the conversation. Building a script around a comfortable flow of conversation is the only way to make them work. Talking at people or asking obscure questions will consistently fail, especially in the B2C world.

Mortgage Protection Cold Calling Script #2

This script and the following financial planning scripts are from financial advisor Dave Kinder, who shows us the value in asking the right questions:

“I’m DHK – the local (company) agent here in (city). Do you have a quick minute to talk?” (It’s either a ‘yes’, ‘no’ or ‘what’s this about?’)

“I’m calling to ask you a simple question: Do you have the type of insurance that would pay off your mortgage for your family if something were to happen to you or your spouse?”

or

“Do you have the type of insurance that would replace your income for your family if something were to happen to you?

May I ask how you feel about that?

Do you think this kind of program might be useful for your situation?

How do you mean?

Do you think it might be worth getting together for about 15 minutes to talk about it and see what you can do about it?”

Financial Planning Cold Calling Script #1

“I’m DHK – the local (company) agent here in (city). Do you have a quick minute to talk?” (It’s either a ‘yes’, ‘no’ or ‘what’s this about?’)

“I’m calling to ask you a simple question. If I could show you how to:

– reduce or eliminate your debts

– fund your children’s education

– get all the life insurance you need to protect your family and

– have the retirement of your dreams,

without you

– taking additional money out of your pocket or sacrificing your lifestyle,

would it be worth sitting down and talking about?

Now since I know you don’t know me from Adam, I recommend that we get together for just 15 minutes and I can give you a PREVIEW of the kind of work I do. I’ll only take 15 minutes. I get to meet you, you get to meet me, and we can then both decide if it makes sense for us to move forward together. How does that sound?”

These are powerful scripts because they are simple and direct. You aren’t messing around on the phone and you are very clear as to what you offer.

Of course, to do this, you’ll have to actually have a plan for the “15-minute preview.” For the cheap method, sign up for the Virtual Assistant for free for 30 days and get the Priority Approach PDF for your market.

Financial Planning Cold Calling Script #2

Dave also presents an alternative way to cold call for financial planning utilizing the ‘thermometer approach’ that asks prospects to qualify their situation instead of reacting to yes or no questions that can easily close down the call:

But here’s the idea: Your job is to sell ‘peace of mind.’ If a prospect feels that you can help enhance their peace of mind, they may choose to meet with you and experience the kind of work you do.

Here’s what I say and do:

“Hello X? My name is DHK. I’m a Lifetime Wealth & Retirement Manager here in (city). Do you have a quick minute to talk? (Or… Is this a good time to talk for a quick minute?)”

“I manage the finances for a few families here in town, and thought I might reach out to some of my neighbors. And so, I’m reaching out (or I’m out and about) asking this: ‘On a scale of 1 to 10, where a 10 is absolute perfection and a 1 is a train-wreck disaster, how would you rank your overall financial situation today?”

If they say “10” they’re blowing you off. Just ask if they can think of any way you can be of help. They’ll probably say ‘no,’ so thank them for their time. Move on.

If they say 1-4, there may be some serious issues and they may not be a good prospect. Ask a few questions, but they’ll probably not be the ideal prospect for you right now.

If they say 5-9, that’s the ‘sweet spot’ because things are ok, but they would like some improvements.

“If you had a realistic magic wand and could turn your situation into a ’10,’ what would you like to see changed?”

Make sure you’re actually LISTENING, and if they mention some of the things where you can help, say so in a question like this:

“If I could help you to reduce or eliminate your debts, fund college educations for your children, get the life insurance you need to protect your family, pay off your home 5 to 10 years early, and have the retirement of your dreams, would it be worth sitting down and talking about?”

Now set up a good time to meet.

You can also add something to the effect of: “Just to let you know a little about how I work: During this first meeting, I won’t be asking you to buy anything. We’ll simply be talking, and I’ll be asking you a few questions about your situation, and you can judge me and my work for yourself.”

Let me ask you this: After reading this, have I evoked an emotional response? Does it matter if you have other advisors or other policies? I’m talking about a process and a methodology of helping the client with ALL their financial goals… not just to ‘evaluate their policy.’

Medicare Supplement Cold Calling Script #3

This script is by one of our book collaborators, Thomas Massey, and how he approaches qualifying prospects when cold calling:

“Hi Jill? Robert calling. Hey, I just wanted to give you quick update to what’s happening with your Medicare. You do have a Medicare Supplement plan, correct?

Great, I don’t know if you’ve heard, but with all the changes to Medicare, rates are going up. Every day I talk to seniors who are overpaying for their Medicare Supplement, and most don’t know that there are better options out there.

I don’t know if that’s the case with you, but if you haven’t had your rate shopped in a while, there’s a pretty good chance you may be overpaying. It only takes a few seconds to find out, I just have to ask you a few questions about your plan. Would that be ok?”

When you get their permission to quote, don’t lead with asking what company they’re with. Just find out what plan they’re on, their age, their tobacco use, and say this:

“Well, based on what you told me, you should be paying $xx for that plan. Is that close to what you’re paying, or are you paying significantly more?”

Final Expense Burial Insurance Cold Call Script

This script is by Stephen from the forums, and his approach is simple: don’t ask if they’re interested in setting an appointment; ask if they’re interested in more information – then just stop by and door knock the lead like you would with a direct mail reply card lead.

“Good afternoon, Mrs. Jones, this is AGENT with COMPANY and I am calling to ask if you have any interest in receiving an information package our term life/funeral and burial/Widget Insurance program. Great, how old are you, Mrs. Jones? Tobacco? Address? Great, well I appreciate your time, Mrs. Jones, I am going to have someone from my office drop off your information package next week.”

General Life Insurance Cold Calling Script

Echoing Matt’s layout of a cold call in the last section, another one of our book collaborators, Ron Van Deusen, shares the general life insurance script he makes cold calls with:

“Hi Bob? This is AGENT; you won’t recognize the name because I’m just cold calling off a list, and I hate making these calls as much as you hate getting them. Would it be ok if I take 30 seconds to tell you why I’m calling and then you can decide if you want to hang up on me?” (The vast majority of people will laugh and say, “Go ahead.”)

“I’m a life insurance agent in your town and a lot of our clients used to be worried about not having the right amount of coverage, if any; some were confused about what was the right coverage for them, and others were just paying too darn much for what they had. Are any of these a concern for you?”

Turning 65 (T65) Cold Calling Script

Simon Yule shares his script that generates additional commissions by mentioning other products he cross-sells:

“Hi, is [name] there? Hi, Mr./Ms. [name] this is [agent name] from ______. I was asked to give you a quick call because our records indicate that you’re turning 65.”

(What records?)

“Our Medicare Supplement agents have a database of everyone turning 65. Have you received your award letter from Medicare?”

(If yes) “Great!”

(If no) “By now, you should have received a letter from the Social Security Administration about your Medicare benefits. You didn’t get that?”

(either way continue on)

“Mr./Ms. [name], I work with Medicare beneficiaries like yourself to help them understand how Medicare works and to make sure you’re getting all the benefits you can, like help lowering your prescription drug cost. “

If there is an objection, use any of the options below:

“We need to discuss all of your options, including:

[Medicare Supplement plans, which help provide for expenses not covered under original Medicare.]

[Senior Dental plans, which are specifically designed for seniors with no restrictive networks and a generous choice of benefits.]

[Hospital Indemnity plans, which pay for unplanned expenses that are not covered by your regular health insurance.]

[First Diagnosis Cancer plans, which following a diagnosis of cancer, will pay you a lump sum benefit that can be used however needed.]

[Final Expense plans, which are a simple solution to final expenses even if you have had difficulty obtaining coverage in the past. And I’m sure you know Social Security only provides $255.]”

“I would like to drop by (day of the week) with some very important information.

Is morning or afternoon better for you?”

“OK, be sure to write down that [agent name] from [company] is coming by tomorrow between [time 1] and [time 2].”

“You’re still at [confirm address] right?”

“Are you married?”

(If yes, be sure spouse will be there)

(If no) Is there anyone who helps you make your health care decisions? Will that person be there tomorrow?” (If not, find a time when they will be)

“If there’s anyone you feel comfortable with that you’d like to have with you, please feel free to invite them over.”

“I’ll see you [date] [time]. Have a great day!”

Turning 65 (T65) Cold Calling Script

This script is by an agent that calls himself the Axeman:

“Hi Judy, this is _____, I’m with ________, and I was just calling because I see that you are in your open enrollment period for Medicare and was wondering if you have had the opportunity to sit down with someone who could provide you with the information that you will be needing. Have you had the chance to do that yet?

Great, I will be in your neighborhood on ______ and ______; what day would be better for you? ok, and are you more of a morning person or afternoon?”

At this point I do a little fact finding, solidify the appointment by having them write it on their calendar, asking for directions and a gate code if needed. I only call T65s that are 3-4 months out, it takes me an average of about 1.5 hours to make an appointment, but by doing it like this I do not get too many tire kickers and end up closing about 50% of the appointments.

Turning 65 (T65) Cold Calling Script

Another agent by the name Windi relays his turning 65 strategy that incorporates direct mail to increase rapport and marketing touches:

“Hi, is ____________ there? Hello, _______ my name is __________ and I’m calling in regards to your upcoming eligibility into Medicare here in ____________, and the possible need for a Medicare Supplement. Now, is this something you’ve started looking into yet, or are you just now getting stuff in the mail?”

Their response usually tells me what my next step is. They either tell me they are just now looking into it, or they tell me they don’t need it and why. Depending on why they think they don’t need it, depends on how I go on with the conversation, because sometimes there is no use continuing the talk. But other times, if they say they’ve already picked a plan or taken care of it, then I can ask them what they’ve decided and go from there.

If they say they’ve been looking into it, I say:

“Great! Well, I’m an independent agent that specializes in Medicare, and what I do is meet with people like you who are just looking into their options. I sit down with you, go over how Medicare works, and how the supplements work. I am an independent broker, so I can get you prices on any of the companies you may want to go with. Now, how is __________ (whatever day you want to meet) looking for you? Are you a morning or afternoon person?” I then set the appointment.

If I get someone who isn’t interested at the time, or is still working or I can’t set the appointment for some other reason, I ask them if I can send them a letter and card for when they do need help. They always say yes. I’ve actually had about 5-8 call backs in two months from people whom I’ve send letters to, for a meeting.

In the next section, we will go over 20 tips to help you successfully cold call, and we will also disclose even more scripts within those tips – so be sure to go through them all!

6. 20 Tips to Help You Cold Call Successfully